Information required under the EU Sustainable Finance Disclosure Regulation (the “SFDR”)

Integration of sustainability risks

Apera Asset Management GmbH (“Apera”), as investment advisor licensed by the German Federal Financial Supervisory Authority (BaFin), is required to disclose certain information about the consideration of sustainability aspects in its investment advice according to Regulation (EU) 2019/2088 (“SFDR”).

Integration of sustainability risks

Apera integrates sustainability risks into its investment advice.

Sustainability risk is an environmental, social or governance event or condition that, if it occurs, could cause an actual or potential material negative impact on the value of an investment.

Apera’s policy on the integration of sustainability risks in its investment advisory process is as follows:

Apera recognises the impact underlying investments may have on the environment and society. As such, Apera is committed to considering material environmental, social and governance (ESG) issues during its due diligence and in the monitoring of portfolio investments, subject to the provisions of the partnership agreement and the memorandum of the funds in relation to which it acts as investment advisor. For the purposes of this disclosure, “material” ESG issues are defined as those issues that Apera determines to have a direct and substantial impact on an organisation’s ability to create, preserve, or erode economic value, as well as environmental and social value for itself and its stakeholders.

In January 2018, the Apera group further elevated its ESG commitment by becoming a signatory to the United Nations Principles of Responsible Investment (the “UNPRI Principles”). In becoming a signatory, the Apera group formalised a commitment to achieving high standards of corporate governance, business integrity and professionalism in all activities. As such, Apera’s ESG Policy is based on guidelines that are consistent with these principles.

Apera believes that incorporation of ESG issues in the investment advisory process can positively affect the performance of investment portfolios and that applying the UN PRI Principles may better align investors with broader objectives of society.

Apera considers material ESG issues throughout its activities as investment advisor to the Apera funds, from due diligence to portfolio monitoring. The level of ESG related work is performed on a risk basis, with key considerations including the industry the business operates in, the locations it operates in and its ownership and business structure.

At the origination stage, Apera will identify any ESG red flags and consider jurisdictional ESG issues such as local governance, legal systems, ESG policy and regulation. At the due diligence stage, Apera will conduct ESG due diligence and include an ESG summary, as applicable, in the fund’s investment memorandum.

Apera will encourage the companies which it recommends for investment to consider relevant ESG issues, with the goal of improving performance, minimising adverse impacts in these areas and ultimately providing long-term sustainability for the benefit of multiple stakeholders of their clients. Apera will include ESG reporting requirements for borrowers in terms. During the investment holding period, Apera will carry out on-going ESG monitoring, support improvements at the companies which it has recommended as investment to consider relevant ESG issues, identify the potential positive impacts of ESG considerations at the investment level and provide ESG reporting to investors. Examples of engagement activity include requesting management changes (e.g. board independence) and including ESG agenda items in regular borrower meetings.

Apera maintains a robust list of explicitly avoided areas for investment recommendations including, but not limited to, the following areas:

- Companies that utilise child or forced labour;

- Companies that maintain discriminatory policies;

- Gun-manufacturing;

- Tobacco; or

- Pornography.

Apera’s commitment to responsible investing extends beyond its investment advisory activities. Apera embraces the ESG impact of its own operations by upholding high standards of business conduct, being a responsible employer and creating an equal opportunities culture.

The purpose and ultimate goal of this ESG work is that Apera not only adheres to all relevant regulations and compliance demands, but also that the work Apera does in the context of its investment advisory process and across its portfolio companies contributes positively to employees and, therefore, to society at large.

No consideration of adverse impacts of investment advice on sustainability factors

Apera does not consider any adverse impacts of investment decisions on sustainability factors in its investment advice. This decision is subject to regular review by Apera's management.

Sustainability factors are environmental, social and employee matters, respect for human rights, anti-corruption and anti-bribery matters.

Apera does not currently consider adverse impacts of investment decisions on sustainability factors in its investment advice as it is currently not in a position to obtain and/or measure all data required to report under SFDR, or to do so systematically, consistently and at a reasonable cost. This is in part because underlying investments that Apera is advising on are not widely required to, and may not currently, report by reference to the same data.

Information on how Apera’s remuneration policies are consistent with the integration of sustainability risks in its investment advisory process

Apera is required to publish information on how its remuneration policy is consistent with the integration of sustainability risks into the investment advisory process. Apera’s approach to remuneration promotes sound and effective risk management and does not encourage risk-taking which is inconsistent with the risk appetite or the risk profile of the portfolios in relation to which it provides investment advice. Apera considers that integration of sustainability risk considerations, where relevant to investment performance, is consistent with its remuneration policy, as such considerations can positively affect the performance of the investment portfolios for which it acts as investment advisor.

Date of publication: 10 March 2021

Last update: 24 June 2024*

*In this update, only the wording was revised. The content of the information remained unchanged.

LEI Apera Asset Management GmbH: 213800QRM5V2DH5B3I63

SFDR Website Disclosure for Apera Private Debt Fund III SCSp

a) Summary

The Fund recognises the impact its underlying investments may have on the environment and society. As such, the Fund is committed to:

- Considering material ESG issues during its pre-investment due diligence and during the lifetime of portfolio investment.

- Promoting, for at least 80% of the portfolio (measured by capital commitments), the set of environmental and social characteristics described below.

- Ensuring portfolio companies complete an annual ESG questionnaire (including data in relation to the “principal adverse impact indicators” listed in Table 1 of Regulation (EU) 2022/1288) and provide regular updates on ESG topics, such as environmental or health and safety incidents.

b) No sustainable investment objective

The Fund promotes environmental or social characteristics but does not have sustainable investments as its objective.

c) Environmental or social characteristics of the financial product

The Fund recognises the impact its underlying investments may have on the environment and society. As such, the Fund is committed to considering material ESG issues during its due diligence and in the monitoring of portfolio investments. For this purpose, "material" ESG issues means those issues that the Fund determines to have a direct and substantial impact on an organisation’s ability to create, preserve, or erode economic value, as well as environmental and social value for itself and its stakeholders.

The Fund’s ESG policy follows the same principles as those of Apera, which are based on the United Nations Principles of Responsible Investment.

The Fund intends to promote, for at least 80% of the portfolio (measured by capital commitments), the following environmental and social characteristics:

- Permanent job creation

- Employee health and safety

- Inclusion, equality, and diversity

- Climate change

- Sustainability of resources and efficiency of energy consumption

The Fund also intends to promote, for at least 80% of the portfolio (measured by capital commitments), processes at portfolio companies for improving sustainability practices, such as implementation of an ESG policy, setting ESG related action plans and related undertakings and margin ratchets in legal documentation.

d) Investment strategy

What investment strategy does this financial product follow and how is the strategy implemented in the investment process on a continuous basis?

The Fund provides financing solutions to European small and medium-sized enterprises based in the UK and Ireland, the DACH region, France, the Benelux region and the Nordic region. The Fund has an opportunistic approach, targeting cash generative businesses operating in industries with long-term growth opportunities (e.g. business services, healthcare and IT services).

In pursuing this investment strategy, the Fund intends to promote, for at least 80% of the portfolio, the following social and environmental characteristics:

- Permanent job creation

- Employee health and safety

- Inclusion, equality, and diversity

- Climate change

- Sustainability of resources and efficiency of energy consumption

What are the binding elements of the investment strategy used to select the investments to attain each of the environmental or social characteristics promoted by this financial product?

The binding elements of the investment strategy used to select the investments to attain each of the environmental or social characteristics promoted by the Fund are as follows.

Pre-investment period

- Exclusion and negative screening list: Apera excludes target investments based on sector, products or services, or certain activities considered undesirable. The exclusion and negative screening list are communicated to the investment teams and reviewed on a periodic basis.

- Pre-investment ESG questionnaire: Apera ensures that the targeted investment complies with Apera’s sustainability requirements and exclusion policy and identifies any sustainability “red-flags” or opportunities.

- ESG investment criteria checked by ESG committee: Apera’s ESG committee is responsible for identifying and considering specific ESG issues in transactions, and the firm’s overall ESG policies.

- ESG clause in credit agreements: for most transactions, Apera will include a commitment in the credit agreement for the portfolio company to complete an annual ESG questionnaire and provide additional information on ESG topics, such as environmental or health and safety incidents.

- ESG margin ratchet: Apera will, for certain transactions, use ESG KPIs as margin ratchet criteria in loan documentation, with target levels fixed for each year.

Holding period

- Annual reporting ESG questionnaire: Apera submits an ESG questionnaire (containing approximately 50 ESG questions) to each portfolio company and consolidates and analyses the data collected.

- Identification of positive or negative ESG impacts at portfolio companies.

- ESG agenda items in regular meetings between Apera and portfolio companies.

Apera considers ESG matters at the pre-investment period and during the holding period because it believes that such considerations address long term risks, ensure compliance with law and best practice and help to preserve and increase value at portfolio companies.

What is the policy to assess good governance practices of the investee companies?

Apera is committed to aligning all its investments with the UN Guiding Principles on Business and Human Rights. This reinforces its recognition of the importance of respecting human rights and fundamental freedoms, of the requirement for businesses to comply with applicable laws, and of the need for rights and obligations to be matched to appropriate and effective remedies when breached.

By aligning investments with the OECD Guidelines for Multinational Enterprises, the Fund commits to meeting the principles and standards for responsible business conduct, consistent with applicable laws and internationally recognized standards, as set out by the OECD.

Apera has adopted the following policy to assess the good governance practices of portfolio companies:

- Encourage portfolio companies to consider relevant governance issues, with the goal of improving performance, minimizing adverse impacts in these areas, and ultimately providing long-term sustainability for the benefit of multiple stakeholders.

- Commit portfolio companies to comply with applicable national, state, and local labour laws in the jurisdictions in which it invests.

- Continue to respect the human rights of those affected by its investment activities.

- Encourage appropriate levels of oversight in the areas of audit, risk management and potential conflicts of interest.

- Commit portfolio companies to maintain strict policies that prohibit bribery and other improper payments to public officials, consistent with the UK Bribery Act 2010 and the U.S. Foreign Corrupt Practices Act of 1977 and similar laws in other jurisdictions in which it invests.

The pre-investment ESG questionnaire includes the following good governance indicators: litigations and controversies, presence in countries at risk of corruption and human rights abuses, cybersecurity breach, diversity at the executive committee and board level and sustainability governance.

The annual reporting ESG questionnaire includes the following additional good governance indicators: members of the board (including proportion of women and independent members), members of the executive committee (including proportion of women), Corporate Social Responsibility (CSR) governance, report and public commitments, ethics policy, litigation related to business ethics, compliance with UNGC principles and OECD Guidelines, violation of OECD or UN Global Compact principles, responsible purchasing, data and cyber-security practices and cyber-security breaches.

Best practices in governance (based on the sector and portfolio benchmark) are also discussed at board meetings with the management of the portfolio companies.

Does this financial product consider principal adverse impacts on sustainability factors?

The Fund will encourage the companies in which it invests to consider relevant environmental, social and governance issues, with the goal of improving performance, minimising adverse impacts in these areas and ultimately providing long-term sustainability for the benefit of multiple stakeholders.

As such, Apera will consider and monitor data in relation to principal adverse impacts in the following manner. During the pre-investment stage and the holding period, Apera intends to collect for the Fund data in relation to the “principal adverse impact indicators” listed in Table 1 of Regulation (EU) 2022/1288 in relation to each portfolio company on an ongoing basis and provide that information in the Fund’s annual report.

In addition, Apera intends to collect and report data in relation to the following adverse sustainability indicators listed in Table 2 of Regulation (EU) 2022/1288: “Investments in companies without carbon emission reduction initiatives”, “Rate of accidents” and “Number of days lost to injuries, accidents, fatalities or illness”.

Apera’s Investment Committee will identify any principal adverse impacts at the time of investment and monitor those impacts during the holding period and raise them as appropriate for discussion at board meetings of portfolio companies.

The principal adverse impacts at the Fund level will be reported at least on an annual basis in the periodic reporting of the Fund.

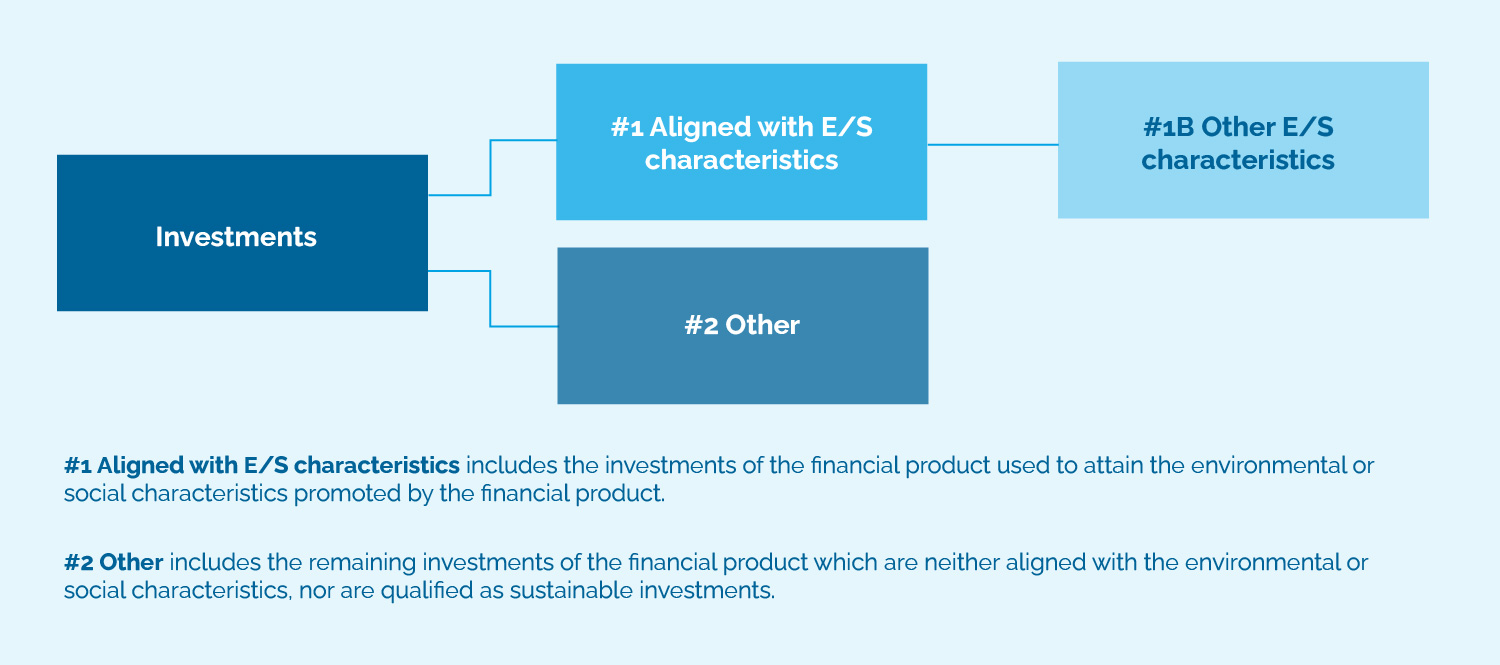

e) Proportion of investments with environmental or social characteristics

What is the planned asset allocation for this financial product?

The Fund intends that at least 80% of aggregate commitments will be invested in portfolio companies which are aligned with the environmental and social characteristics promoted by the Fund as described above.

The Fund promotes environmental and social characteristics without having sustainable investment as its objective in the meaning of SFDR. The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

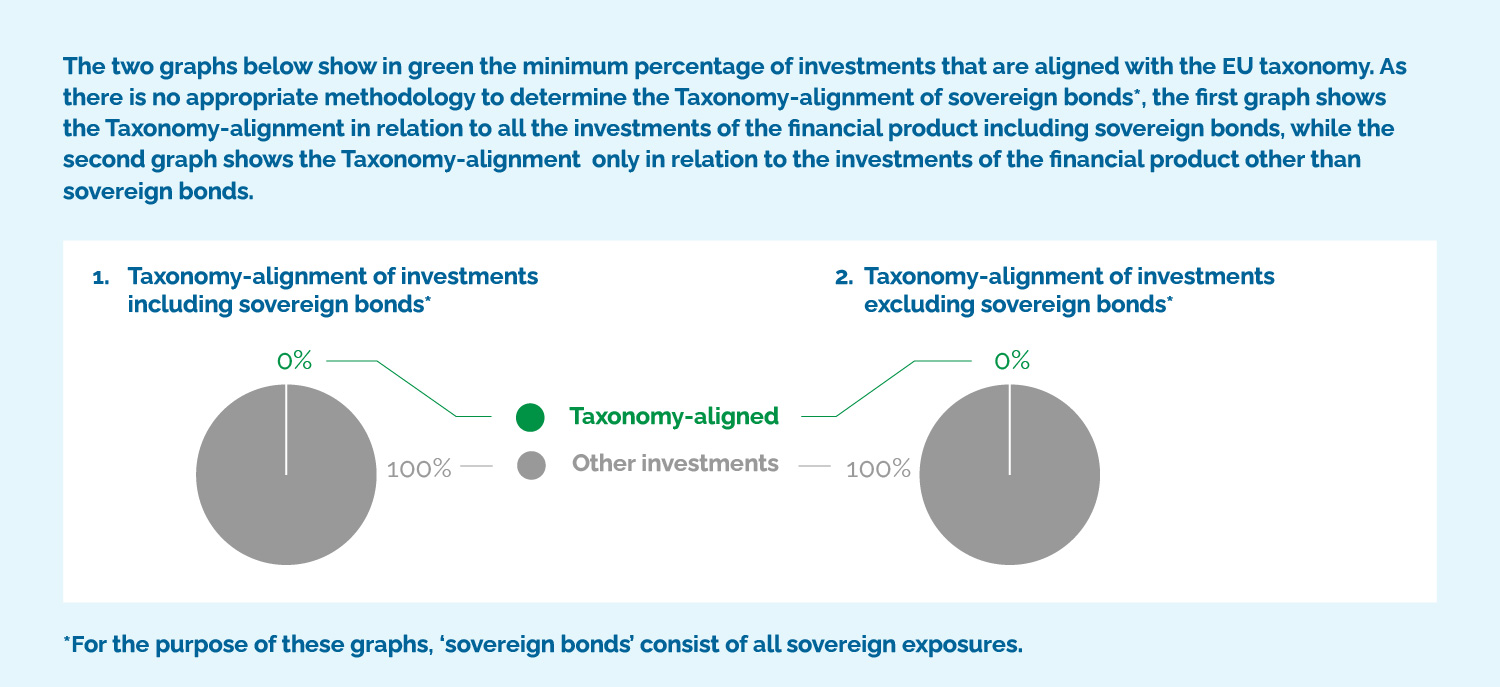

What is the minimum share of investments with an environmental objective aligned with the EU Taxonomy? (including what methodology is used for the calculation of the alignment with the EU Taxonomy and why; and what the minimum share of transitional and enabling activities)

The Fund does not commit to make sustainable investments with an environmental objective aligned with the EU Taxonomy. Hence, the Fund’s share of sustainable investments with an environmental objective aligned with the EU Taxonomy will be zero and the minimum share of investments in transitional and enabling activities within the meaning of the Taxonomy Regulation is therefore also set at 0%.

What is the minimum share of sustainable investments with an environmental objective that are not aligned with the EU Taxonomy?

The Fund does not commit to make sustainable investments with an environmental objective aligned with the EU Taxonomy or not aligned with the EU Taxonomy.

What investments are included under “#2 Other”, what is their purpose and are there any minimum environmental or social safeguards?

“Other” investments are investments for which the Fund does not promote environmental and social characteristics. These investments include investments originally made by Fund I or Fund II in which the Fund will participate. Apera will apply its exclusion and negative screening list to all such investments and will require all such investments to complete its annual reporting ESG questionnaire, including reporting on principal adverse impacts. “Other” investments also include cash.

f) Monitoring of environmental or social characteristics

What sustainability indicators are used to measure the attainment of the environmental or social characteristics promoted by this financial product?

Prior to investment, Apera will conduct an ESG pre-investment questionnaire during the due diligence phase.

Furthermore, Apera will use the following sustainability indicators to measure the attainment of the environmental and social characteristics described above. Apera will monitor and report on these indicators with quantitative and qualitative data, on an ongoing basis for investments through an ESG annual questionnaire.

- Permanent job creation

- Number of permanent employees

- Net number of jobs created, number of hires and departures

- Redundancy or restructuring plans

- Employee health and safety

- Health and safety policy or action plan

- Accident frequency rate

- Accident severity rate

- Fatal injuries

- Absenteeism rate

- Well-being at work and employee satisfaction

- Welfare plan beyond legal requirements

- Inclusion, equality and diversity

- Proportion of women in the Board and in the Executive Committee

- Proportion of permanent women employees

- Unadjusted gender pay gap

- Diversity commitments and policies

- Climate change

- Participation in coal-related activities

- Non-renewable energy consumption and production

- Carbon footprint assessment (Scope 1, 2 and 3 greenhouse gas emissions)

- Climate change risk assessment

- Climate change exposure: physical and transition risks

- Sustainability of resources and efficiency of energy consumption

- Renewable energy consumption and production o Environmental impact reduction initiatives

- Responsible procurement policy

- Corporate social responsibility and ESG criteria in the selection and/or monitoring of suppliers

- Efficient use of resources and raw materials

Apera may revise this list of indicators from time to time, as it considers necessary, to reflect changes in law, more general developments in ESG concerns and stakeholder demands.

Investors should note that the Fund may not in practice be able to obtain complete or consistent ESG related data from portfolio companies.

g) Methodologies for environmental or social characteristics

The methodologies to measure the attainment of the sustainable investment objective are described above.

h) Data sources and processing

The data sources to attain the sustainable investment objective are primarily the portfolio companies in which the Fund invests. The data form the portfolio companies is collected on an annual basis through an online reporting software and the consistency of the data is checked by the specialized software provider. Other third party sources include ESG due diligence reports prepared by consultants during the investment due diligence phase as well as carbon footprint analysis reports which some portfolio companies share.

i) Limitations to methodologies and data

Given Apera’s investment focus is on small and medium-enterprises, data availability can be limited, as ESG reporting may be in its primary stages at initial investment. ESG reporting and data availability is typically enhanced during the life of the investment by the financial sponsor and progress is tracked due to the annual ESG reporting. Investors should note that the Fund, as a lender and not equity owner, cannot generally request ESG data over and above the requirements initially included in the financing documentation (including completion of annual ESG questionnaire, and providing additional information on ESG topics, such as environmental or health and safety incidents).

j) Due diligence

Apera conducts due diligence investigations for each investment. Apera uses a pre-investment ESG questionnaire to ensure that the targeted investment complies with Apera’s sustainability requirements and exclusion policy, and to identify any sustainability “red-flags” or opportunities.

The pre-investment ESG questionnaire includes the following good governance indicators: litigations and controversies, presence in countries at risk of corruption and human rights abuses, cybersecurity breach, diversity at the executive committee and board level and sustainability governance.

The local deal team are responsible for identifying and considering specific ESG issues in transactions, supported by Apera’s ESG committee.

k) Engagement policies

During the holding period, Apera submits an ESG questionnaire (containing approximately 50 ESG questions) to each portfolio company and consolidates and analyses the data collected. The results identify positive and negative ESG impacts of portfolio companies. Apera also includes ESG agenda items in regular meetings between Apera and portfolio companies. ESG is also discussed at board meetings with the management of the portfolio companies, where Apera has a board observer seat.

Investors should note that the Fund, as a lender and not equity owner, may have in practice limited ability to engage with portfolio companies.

l) Designated Reference Benchmark

There is no designated reference benchmark for the Fund.

m) Public Disclosures

Public disclosures for Fund III, ESG policy and ESG reports (including scope emissions) available upon request.